Decode.tax

Analyze tax returns to identify savings opportunities

Target Audience

- U.S. taxpayers

- Self-employed professionals

- Investors with capital gains

- Financial advisors

Hashtags

Overview

Decode.tax helps you understand your U.S. tax situation by analyzing your tax return. Upload your documents to get personalized recommendations for reducing your tax bill. Your data remains private - the service doesn't store your actual return and lets you delete all information permanently. Get clear insights without worrying about your sensitive financial data being shared or retained.

Key Features

Tax Analysis

Scans entire return to find potential savings

Data Privacy

No tax return storage & instant deletion option

Multi-Category Review

Checks income, gains, deductions, and self-employment

Use Cases

Analyze tax returns for savings

Optimize self-employment deductions

Identify overlooked tax credits

Reduce marginal tax burden

Pros & Cons

Pros

- Prioritizes user privacy with zero data retention

- Provides actionable tax optimization recommendations

- Covers multiple tax categories comprehensively

- Requires no financial commitment (free beta)

Cons

- Currently limited to U.S. tax returns only

- Beta version may have limited features

Frequently Asked Questions

Is my tax return data safe?

We don't store your actual tax return and allow permanent deletion of all data at any time

What tax areas do you analyze?

We review income, capital gains, deductions, self-employment taxes, and marginal tax rates

How do recommendations work?

Our system identifies potential savings opportunities based on your specific tax situation

Reviews for Decode.tax

Alternatives of Decode.tax

Automate tax deductions and filing for self-employed professionals

Streamline your tax preparation for personal and business needs

Simplify cryptocurrency tax calculations and IRS compliance

Simplify business accounting and personal tax filing in one platform

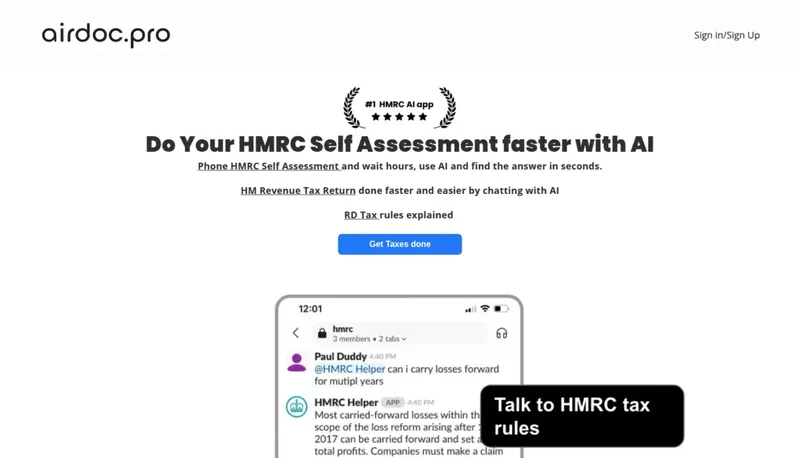

Simplify HMRC tax filings through AI-powered document analysis

Streamline tax research and compliance workflows for professionals

Simplify Canadian tax filing with AI-powered guidance